- Employee resistance is common, as change can be daunting and create anxiety about new systems.

- Further, chosen service providers may also be reticent to change due to the complexity of the technological effort itself.

- There are communication gaps that can lead to misunderstandings about the goals and benefits of changes.

- Insufficient training may leave employees struggling to adapt to new tools or processes.

- New initiatives can disrupt existing workflows, causing temporary inefficiencies.

- Additionally, measuring the return on investment (ROI) for these changes can be difficult.

- First, strong leadership commitment is vital, with leaders aligning their messaging and commitment to inspire confidence.

- Second, clear communication of the vision helps everyone understand the purpose of the change from the outset.

- Third, providing adequate training, resources, and support ensures employees feel prepared for new changes.

- Finally, ongoing reinforcement through incentives and recognition helps embed the new ways of working.

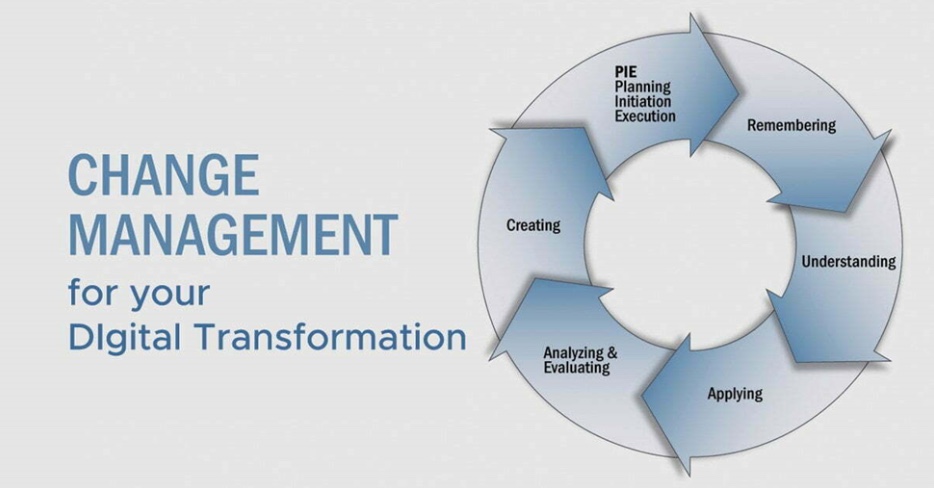

- Phased rollout: Introduce changes in stages rather than all at once

- Pilot programs: Test changes on a small scale before full implementation

- Iterative process: Plan from the beginning to be prepared to adjust based on feedback and results from each phase

- Reduced risk of major disruptions

- Easier management of change resistance

- Opportunity to learn and refine strategies

- Increased likelihood of long-term success

- Defining key performance indicators (KPIs): Identify specific, measurable metrics aligned with organizational goals and incentives

- Regular monitoring: Consistently track and analyze progress against established metrics

- Milestone recognition: Celebrate achievements along the way to boost morale and motivation

- Employee engagement scores

- Productivity measures

- Customer satisfaction ratings

- Financial performance indicators

- Encouraging experimentation: Provide resources and support for trying new ideas

- Learning from failures: Treat setbacks as opportunities for growth and improvement

- Cross-functional collaboration: Incentivize knowledge sharing across departments

- Continuous training: Invest in ongoing skill development for employees

- Increased organizational agility

- Enhanced problem-solving capabilities

- Improved employee satisfaction and retention

- Sustained competitive advantage